Penalty for no insurance in Texas carries significant consequences for drivers. This comprehensive guide explores the intricacies of Texas insurance laws, outlining the specific penalties, potential impacts on drivers, and available legal defenses. Understanding these regulations is crucial for maintaining compliance and avoiding financial and legal repercussions.

Texas law mandates specific types of vehicle insurance, and failure to comply can lead to substantial fines, suspension of driving privileges, and damage to one’s driving record. This document delves into the nuances of these penalties, providing a clear and actionable understanding of the process and possible outcomes.

Overview of Texas Insurance Laws

Yo, the law in Texas about insurance for your wheels ain’t no joke. It’s serious business, and if you’re not up to snuff, you’re lookin’ at a hefty fine. Knowing the rules keeps you out of trouble, and also helps you understand your responsibilities on the road.Texas’ insurance laws are designed to protect everyone involved in a car accident.

They ensure drivers are financially responsible for their actions, and provide a safety net for victims. Whether you’re a seasoned driver or just starting out, understanding these regulations is crucial.

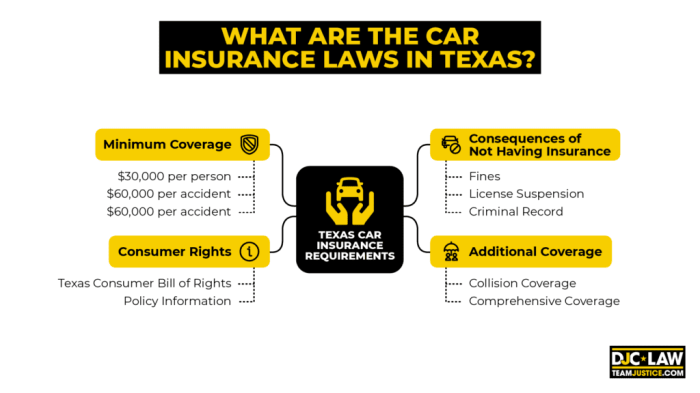

Texas Vehicle Insurance Requirements

Texas demands proof of insurance for all vehicles on the road. This isn’t just some suggestion; it’s a legal mandate. Failure to comply can lead to hefty fines and even license suspension. Insurance protects you from financial ruin if you’re involved in an accident, covering medical expenses, vehicle damage, and other liabilities.

Types of Vehicle Insurance Required in Texas

Texas mandates liability insurance for all vehicles. This covers damages you cause to others in an accident. Beyond liability, there’s also the option to acquire comprehensive and collision insurance, although not mandated.

- Liability Insurance: This is the absolute minimum required. It protects others in case you cause an accident, covering their damages. It’s crucial to understand the coverage limits specified in your policy.

- Comprehensive Insurance: This kind of insurance kicks in when your car gets damaged due to factors like weather, vandalism, or theft. It’s not mandatory, but adds an extra layer of protection.

- Collision Insurance: If your car gets damaged in an accident, no matter who’s at fault, collision insurance steps in to cover the repairs. Again, not a requirement, but can save you from significant financial strain.

Obtaining and Verifying Insurance Coverage

Getting insurance and confirming it’s active is straightforward. Most insurance companies provide documentation, like a certificate of insurance or a digital confirmation. You can also use online portals to check your policy status. Always have this documentation readily available, especially when dealing with law enforcement.

- Insurance Certificates: These documents provide official proof of your insurance coverage, often required for registration and renewals. They include crucial information about policy details and limits.

- Online Verification: Many insurance providers offer online portals for checking coverage status, making verification quick and easy.

Insurance Requirements for Different Vehicle Types

The insurance requirements generally apply to all types of vehicles, but some may have specific nuances. Understanding the requirements for your vehicle type is essential to avoid any potential issues with authorities.

| Vehicle Type | Insurance Requirements |

|---|---|

| Cars | Liability insurance is mandatory. Comprehensive and collision insurance are optional but highly recommended. |

| Motorcycles | Liability insurance is mandatory. Comprehensive and collision insurance are optional but strongly recommended due to higher risk. |

| Trucks | Liability insurance is mandatory. Specific requirements may apply, especially for commercial vehicles, often involving higher coverage limits. |

Penalties for Non-Compliance

Oi, mate, driving without insurance in Texas ain’t no joke. The state’s gonna hit you with some serious penalties, from hefty fines to potential license suspension. It’s a serious business, so make sure you’re sorted with insurance.

Fines for Uninsured Driving

Texas takes a firm stance against uninsured drivers. Different situations lead to different levels of fines. These fines act as a deterrent, aiming to ensure everyone’s covered on the road.

- A basic fine for driving without insurance is a significant amount, often several hundred dollars. This is designed to financially penalize the action and encourage compliance.

- Additional penalties might be tacked on, like court costs or other fees. It’s important to be aware of these added charges when calculating the total cost of non-compliance.

- The specific amount of the fine varies based on the circumstances, but a typical fine for uninsured driving in Texas is usually in the range of hundreds of dollars. This amount can increase depending on any prior offenses.

Driving Privilege Suspension

Failing to maintain insurance can result in the suspension of your driving privileges. This means your license might get pulled, impacting your ability to get around. The severity of the suspension depends on the frequency and nature of the violations.

- A first offense often leads to a temporary suspension, allowing for a chance to rectify the situation.

- Repeated violations or more serious infractions can lead to a longer, more permanent suspension.

- The length of the suspension is determined by the Texas Department of Public Safety, and can vary. The length of time you are without a license can impact your ability to commute to work or even pick up groceries.

Timeline of Penalties

This table Artikels the potential penalties for failing to carry insurance in Texas. It highlights the progressive nature of penalties, designed to discourage repeat offenses.

| Offense Count | Potential Penalties | Timeline |

|---|---|---|

| First Offense | Fine of several hundred dollars, potential temporary license suspension | Typically, the penalties are applied immediately. |

| Second Offense within 3 years | Higher fine, more extensive license suspension | The penalties are likely to be more severe, and the length of suspension is likely to increase. |

| Subsequent Offenses | Increased fines, potential permanent license suspension, possible criminal charges | Penalties become increasingly severe and the potential for more extensive consequences increases with each subsequent offense. |

Impact on Drivers

Yo, dodgy drivers, listen up. Getting slapped with a no-insurance penalty in Texas ain’t just a minor inconvenience. It’s a serious blow to your wallet and your driving future. Think of it like a right hook to your financial wellbeing and a black mark on your driving record.This ain’t some victimless crime. This directly impacts your ability to drive safely and legally.

The penalties can escalate quickly, so understanding the consequences is crucial. Knowing your rights and the appeals process can save you a heap of grief.

Financial Implications

The fines for driving without insurance in Texas are hefty. These ain’t chump change. Depending on the specific circumstances, you could face a substantial financial penalty, potentially exceeding a few hundred dollars. It’s more than just the fine itself, though. Legal fees for appealing a penalty can add to the financial burden.

Consider this a costly lesson.

Impact on Driving Records

A no-insurance violation will absolutely wreck your driving record. It’s a criminal record marker, a permanent stain on your driving history. This ding can affect your ability to get insurance in the future, making premiums skyrocket. Insurers will see this as a significant risk factor, leading to higher premiums and potential rejection. This can make insurance practically unaffordable for you in the future.

You’re looking at a potential roadblock to getting a loan, too, as lenders check your driving record.

Appealing a Penalty

If you believe the no-insurance penalty was wrongly issued, you can appeal it. Texas has a process for challenging such penalties. Consult with a legal professional or the Texas Department of Public Safety to understand the specific procedures and deadlines. Appeals aren’t guaranteed, but they’re definitely worth exploring if you have a valid argument.

So, you’re looking at the hefty penalty for driving without insurance in Texas, right? Well, if you’re thinking about a change of scenery and maybe some investments in apartments to buy in Paphos, Cyprus, check out these options. But remember, no matter where you’re putting your money, you still need that insurance to avoid those serious Texas fines.

So, buckle up and get covered!

Repeated Violations

Driving without insurance isn’t a one-time mistake. Repeated violations lead to increasingly severe penalties. The more you get caught, the harsher the punishment. This can eventually lead to the suspension of your driving license, and the potential for jail time. Don’t take this lightly.

Escalating Penalties for Repeated Uninsured Driving Offenses

| Violation Count | Fine Amount (Example) | Additional Consequences |

|---|---|---|

| First | $200-$500 | Points on license, possible driver’s license suspension |

| Second | $500-$1000 | Points on license, possible driver’s license suspension, increased insurance premiums |

| Third | $1000-$2000 | Points on license, possible driver’s license suspension, significant increase in insurance premiums, potential court appearance |

| Fourth and beyond | Increased fines and penalties | Possible driver’s license suspension, jail time, significant increases in insurance premiums |

Note: The exact fine amounts and penalties can vary based on the specific circumstances and local laws. Always consult with a legal professional or the relevant authorities for the most up-to-date and accurate information.

Legal Defenses and Options: Penalty For No Insurance In Texas

Navigating the concrete jungle of Texas insurance laws can be a right pain. Getting slapped with a penalty for driving without insurance can feel like a brick wall, but there are cracks you can exploit. Knowing your legal options is key to fighting back and protecting your rights.

Common Legal Defenses

Understanding the common legal arguments used to challenge uninsured driving penalties is crucial. These defenses aim to demonstrate that the driver wasn’t truly uninsured or that the circumstances surrounding the incident warrant a different outcome.

- Proof of Insurance Purchase: Showing proof of purchasing insurance, even if the paperwork isn’t immediately available, can be a strong defense. This might include showing proof of payment, receipt, or correspondence with the insurance company. Think about that instant confirmation text from the company after your payment!

- Administrative Error: If there’s evidence of a clerical mistake or an error in the record-keeping process, it can weaken the state’s case. This could involve showing that the insurance company didn’t properly update their records, or that the paperwork wasn’t filed correctly.

- Policy Non-Renewal Dispute: If the driver faced an unexpected policy non-renewal, presenting documentation showing the reason behind the cancellation and steps taken to get new coverage can weaken the penalty. This might involve a letter from the insurer explaining the reasons behind the cancellation.

- Unforeseen Circumstances: Exceptional circumstances, such as sudden job loss or significant financial hardship that temporarily prevented the purchase of insurance, can be valid reasons to dispute the penalty.

Driver Rights

Drivers facing penalties for driving without insurance have specific rights. These rights are designed to ensure fairness and due process.

- Right to a Hearing: Drivers have the right to request a hearing to contest the penalty. This is a chance to present evidence and challenge the state’s claim.

- Right to Legal Representation: Drivers have the right to be represented by an attorney during the hearing process. A legal expert can navigate the complexities of the law and ensure your rights are protected.

- Right to Present Evidence: Drivers have the right to present evidence supporting their defense. This could include documentation, witness testimony, or other relevant materials.

Contesting a Penalty

Challenging a penalty for driving without insurance involves a specific process.

- Notice of Violation: The first step involves carefully reviewing the notice of violation. Understanding the specific charges and details is crucial for developing an effective defense.

- Gathering Evidence: Gathering evidence supporting your defense is essential. This could include insurance documents, proof of attempted coverage, or other relevant materials.

- Filing a Formal Appeal: Following the procedures Artikeld by the relevant Texas authorities is essential for a successful appeal.

- Attending the Hearing: If a hearing is scheduled, it’s crucial to attend and present your case effectively.

Role of a Lawyer

A lawyer plays a crucial role in navigating the complexities of contesting a penalty for driving without insurance.

- Expert Legal Guidance: A lawyer can provide expert legal guidance, explaining your rights and the best course of action.

- Evidence Gathering and Analysis: A lawyer can help gather and analyze evidence to build a strong case.

- Representation at Hearings: A lawyer can represent you at any hearings or court proceedings, ensuring your rights are protected.

Comparison of Legal Options

This table provides a quick overview of the different legal options available to drivers facing penalties for driving without insurance.

| Legal Option | Description | Potential Outcome |

|---|---|---|

| Contesting the Penalty | Challenging the penalty through the formal process | Potential reduction or dismissal of the penalty |

| Negotiation with the State | Seeking a resolution through direct negotiation with the state | Possible reduction of penalties or alternative solutions |

| Seeking Legal Representation | Engaging an attorney to assist in the process | Increased chances of success and protection of rights |

Resources for Insurance Information

Navigating the insurance game in Texas ain’t no walk in the park. You need the right info to get the best deal, and avoid getting nicked by the law. This section’s gonna break down where to find the lowdown on Texas insurance, how to bag a decent policy, and who can help you out if you’re stuck.Understanding the ropes is crucial for smooth sailing.

Knowing your rights and responsibilities, coupled with access to reliable resources, makes the whole process way less stressful.

Insurance Requirements in Texas

Texas has specific rules about insurance. Failing to meet these can land you in a whole heap of trouble. To avoid any dramas, you gotta be clued up on what’s required. Knowing the rules and regulations is key to staying on the right side of the law. This helps you stay out of hot water and avoid potential penalties.

- The Texas Department of Insurance (TDI) website is your first stop for the latest info on insurance laws. This site’s a goldmine for everything from policy details to recent updates.

- The Texas Department of Motor Vehicles (DMV) can also give you the lowdown on your state’s requirements. This includes details on what insurance types are valid and how to prove you’re covered.

- Local consumer protection agencies and non-profit organizations provide valuable support. They offer guidance and assist with navigating the maze of insurance options.

Finding Affordable Insurance

Getting affordable insurance in Texas can feel like hunting for a needle in a haystack. But there are strategies to get the best possible deal. A bit of savvy and the right approach can make all the difference.

- Compare quotes from different providers. Don’t just go with the first one you see. Shop around, get multiple quotes from various insurers, and compare policies based on coverage and premiums.

- Consider discounts. Many insurance companies offer discounts for safe driving, good student status, or for bundling policies. It’s worth checking for these extras to potentially reduce your monthly outlay.

- Look into high-risk insurance options. If you have a history of accidents or other factors that make you a higher-risk driver, specialized high-risk insurance providers might be able to help. Be sure to do your homework and get several quotes.

- Be aware of financial assistance programs. Some organizations provide financial support for people struggling to afford insurance. Research local or state initiatives to see if you qualify for help.

Insurance Assistance Organizations

Navigating the world of insurance can be tough. Thankfully, there are organizations dedicated to helping people. These groups offer support and guidance.

- Consumer protection agencies at the state and local levels are a great resource for resolving disputes or getting clarifications. They can offer guidance and help you navigate the complexities of the insurance process.

- Nonprofit organizations often provide free or low-cost assistance with insurance matters. Check your local community for such organizations to get guidance and support.

Insurance Provider Comparison

Choosing the right insurance provider can be tricky. Understanding their services is key to making the right decision.

| Insurance Provider | Services Offered | Pros | Cons |

|---|---|---|---|

| State Farm | Comprehensive auto insurance, home insurance, and life insurance | Wide range of products, established brand, good customer service | Premiums might be higher than competitors |

| Progressive | Auto insurance, discounts for safe driving, online quoting | Easy online quoting, diverse discounts, competitive rates | Customer service experience can vary |

| Geico | Auto insurance, roadside assistance, online tools | Competitive rates, user-friendly online platform, discounts | May have limited coverage options for specific situations |

| Allstate | Auto insurance, home insurance, renters insurance | Wide range of insurance products, local service agents | Premiums might be higher compared to some competitors |

Finding Insurance Coverage in Texas

The process of getting insurance in Texas involves several steps. Following this process will help you secure coverage efficiently.

- Gather the necessary information, including your driving history, vehicle details, and any discounts you qualify for.

- Compare quotes from multiple providers to find the best rates and coverage for your needs.

- Review the policy details thoroughly before signing up. Make sure the coverage matches your requirements and you understand the terms and conditions.

- Ensure you have the necessary documentation and sign all required paperwork. Be thorough to avoid any issues later.

Illustrative Case Studies (Hypothetical)

Navigating the murky waters of Texas insurance laws can be tricky, especially when the penalties for non-compliance are on the table. These hypothetical cases highlight the potential consequences of driving uninsured in the Lone Star State, offering a glimpse into the realities faced by drivers who disregard the regulations.

Case Study 1: The Uninsured Rookie

A recent graduate, fresh out of uni, bought a banger of a car, but neglected to sort out insurance. They thought it’d be a cheap thrill, but it wasn’t. A minor fender bender resulted in a hefty fine, plus points on their licence. The insurance company refused to cover any damage to the other vehicle, leading to a hefty repair bill.

The graduate ended up having to pay for the other car’s repairs, plus the insurance company’s administrative costs. The outcome was a lesson learned, but with a painful financial sting.

Case Study 2: The “I’ll-sort-it-later” Driver

A seasoned worker, accustomed to juggling many things, put off sorting their insurance. A routine check-up revealed their insurance had lapsed, triggering a hefty fine. The court imposed a substantial financial penalty and suspended their driving license. The consequences included difficulty in getting to work and various other logistical challenges. This case demonstrates the severe repercussions that can arise from procrastination when it comes to insurance obligations.

Case Study 3: The “I-can-handle-it-myself” Entrepreneur

An ambitious entrepreneur, focused on launching a new business, overlooked their insurance renewal. They believed they could handle the administrative tasks themselves, but the oversight led to a hefty fine, plus the loss of their vehicle registration. This led to further complications in conducting their business. They had to pay for the administrative costs for the registration and insurance.

The outcome was a setback for their business ventures.

So, you’re looking at penalties for driving without insurance in Texas? Yeah, it’s a serious deal. Basically, expect hefty fines, and possibly even jail time. Plus, if you get into a wreck without insurance, you’re on the hook for everything. Speaking of financial responsibilities, did you know that Tyler the Creator is performing at the Tyler the Creator State Farm Arena ?

Definitely a cool show, but still, don’t forget that no insurance in Texas means serious trouble. You’re better off having insurance, trust me.

Case Study 4: The “I-don’t-need-it” Road Warrior, Penalty for no insurance in texas

A long-distance trucker, accustomed to hitting the road, opted not to have insurance, believing their experience would make them immune to any issues. Their assumption was wrong. They got into a serious accident, and the consequences were devastating. They were facing not just hefty fines but also potential jail time. Their insurance company refused to cover the damages, leaving them liable for all the costs associated with the incident, including injuries.

The outcome was not just financial, but also a significant threat to their livelihood and freedom.

Summary of Case Studies

| Case Study | Circumstances | Outcome |

|---|---|---|

| The Uninsured Rookie | Minor accident, uninsured, no insurance | Fine, license points, liability for other party’s damages, insurance administrative costs. |

| The “I’ll-sort-it-later” Driver | Insurance lapsed, routine check-up revealed lapse | Fine, license suspension, logistical difficulties |

| The “I-can-handle-it-myself” Entrepreneur | Overlooked insurance renewal, believed in self-sufficiency | Fine, loss of vehicle registration, administrative costs, business complications |

| The “I-don’t-need-it” Road Warrior | Serious accident, uninsured | Fines, potential jail time, liability for all damages, including injuries, loss of livelihood and freedom |

Importance of Understanding Texas Insurance Laws

A solid grasp of Texas insurance laws is crucial for every driver. Ignoring these regulations can lead to significant financial and legal repercussions. Understanding the penalties, the potential outcomes, and the resources available can help avoid costly mistakes. Failing to understand these laws can lead to a chaotic and unpleasant experience.

Comparison with Other States

Yo, check the scene: Insurance laws ain’t no one-size-fits-all across the states. Texas’s rules, while pretty strict, get compared to other states’ approaches, revealing some serious differences in how they handle drivers without cover. From fines to the potential for suspension, the penalties can vary wildly. It’s a complex web, and we’re breaking it down for you.Texas ain’t the only state with a tough stance on uninsured driving.

Other states have similar, and sometimes even harsher, penalties. Understanding how other states handle this issue helps paint a broader picture of the whole situation. This comparison uncovers similarities and differences in the legal requirements and penalties, highlighting the complexity of insurance laws across the country.

Variations in Penalties

Different states employ various strategies for punishing uninsured drivers. Some states focus heavily on fines, while others prioritize license suspension. This section lays out the different approaches.

| State | Primary Penalty | Secondary Penalties | Other Considerations |

|---|---|---|---|

| Texas | Fines, ranging from a few hundred to a few thousand dollars. License suspension is a likely consequence | Potential for vehicle impoundment, driver’s record mark, increased insurance premiums | Driver education programs may be required in certain situations. |

| California | Significant fines and potential license suspension. | Vehicle impoundment, driver’s record mark, and increased insurance premiums | Insurance requirements can vary based on the type of vehicle. |

| Florida | Fines and mandatory driver’s education courses | License suspension, potential for criminal charges | Points on driver’s record that can affect future insurance rates. |

| New York | Fines and suspension of driving privileges | Vehicle impoundment, driver’s record mark | Some counties might have their own specific requirements |

Similarities and Differences in Legal Requirements

Texas ain’t alone in its commitment to mandatory auto insurance. Across the US, most states require drivers to carry liability insurance. The similarities stem from the need to protect victims in accidents. However, the specific requirements and the enforcement of these requirements differ. The table below illustrates some of these nuances.

| Requirement | Texas | California | Florida | New York |

|---|---|---|---|---|

| Minimum Liability Coverage | Statutory minimum coverage | Statutory minimum coverage | Statutory minimum coverage | Statutory minimum coverage |

| Uninsured Motorist Coverage | Required for some coverage types | Required for some coverage types | Required for some coverage types | Required for some coverage types |

| Proof of Insurance | Required for registration | Required for registration | Required for registration | Required for registration |

Complexity of Insurance Laws

Insurance laws are complex because of their impact on everyday life. Understanding how these laws function and how they are applied in different states is crucial. This complexity is further emphasized by the variations in penalties, requirements, and enforcement strategies.

Future Trends and Implications

The laws governing insurance in Texas are constantly evolving, mirroring the ever-shifting landscape of the transport and insurance industries. Changes in technology, societal expectations, and even economic pressures can trigger revisions to existing regulations. Understanding these potential shifts is crucial for drivers navigating the Texas road system.

Potential Future Changes in Texas Insurance Laws

Insurance laws in Texas are likely to adapt to emerging technologies and evolving societal needs. Expect potential adjustments in areas such as digital insurance platforms, usage-based insurance models, and enhanced fraud prevention measures. This responsiveness to modern trends will shape the insurance landscape for both insurers and policyholders.

Analysis of Changes Affecting Drivers

Drivers will need to adapt to these evolving regulations. Usage-based insurance, for example, could incentivize safer driving habits through rewards and discounts, but might also present challenges for drivers with limited access to newer vehicles or technology. New regulations might also impact premiums, potentially affecting affordability and accessibility to insurance coverage.

Technology’s Influence on Insurance Enforcement

Technology is set to play a more significant role in enforcing insurance requirements. Expect increased use of telematics, real-time tracking of vehicles, and AI-driven fraud detection systems. These technological advancements could lead to more precise and efficient enforcement of insurance laws, impacting the ways drivers are monitored and how violations are handled.

Predicted Future Trends in Texas Insurance Laws

| Trend | Description | Potential Impact on Drivers |

|---|---|---|

| Increased Use of Telematics | Insurance companies will increasingly use data from telematics devices to assess driving habits and adjust premiums accordingly. | Drivers with safer driving records may see lower premiums, while those with poor records may face higher premiums. |

| Enhanced Fraud Detection | Advancements in AI and data analytics will lead to more sophisticated methods of detecting insurance fraud. | Drivers will need to be aware of the increased scrutiny and potential consequences of fraudulent activities. |

| Usage-Based Insurance Models | Premiums will be based on real-time driving data, adjusting dynamically based on driving habits. | Drivers with safer driving habits can expect lower premiums, while those with risky driving habits will face higher premiums. |

| Digital Insurance Platforms | Insurance transactions will be conducted more through online platforms, reducing paperwork and increasing efficiency. | Drivers will have greater accessibility and convenience in managing their insurance policies. |

Evolving Nature of Insurance Regulations

The insurance industry is not static. The legal framework that governs it is in constant flux. This dynamism is driven by technological advancements, changing societal norms, and economic factors.

“The evolving nature of insurance regulations demands a proactive approach to stay informed about potential changes and their impact on drivers.”

Staying informed is crucial to avoid potential pitfalls and capitalize on potential benefits.

Last Word

In conclusion, navigating the complexities of penalty for no insurance in Texas requires careful consideration of the legal requirements and potential consequences. Understanding the specific fines, suspension procedures, and available legal defenses is crucial for drivers to maintain compliance and avoid negative impacts on their driving records and future opportunities. This guide serves as a resource to ensure informed decision-making regarding insurance and related legal matters.

Quick FAQs

What are the different types of insurance required in Texas?

Texas mandates liability insurance, which covers damages you cause to others in an accident. Depending on the vehicle type, additional coverages like collision and comprehensive insurance may be required.

How can I verify my insurance coverage?

Insurance verification can be obtained through a variety of means, including providing your insurance policy details, or through an online portal accessible through the Texas Department of Public Safety.

What are the potential consequences of repeated uninsured driving violations?

Repeated violations can result in escalating fines, driver’s license suspension for longer durations, and potential legal action. Repeated violations can also significantly damage one’s driving record and future driving opportunities.

Where can I find resources for obtaining affordable insurance in Texas?

Various organizations, including the Texas Department of Insurance, offer resources and information on finding affordable insurance options in the state. Comparison shopping among different providers is recommended.