Embarking on p&c insurance exam prep is a journey into a world of intricate policies, meticulous procedures, and profound understanding. This comprehensive guide illuminates the path to mastery, equipping you with the knowledge and strategies to confidently navigate the exam. From deciphering complex insurance products to mastering essential exam techniques, this resource will be your trusted companion.

This resource meticulously dissects the core components of P&C insurance exam prep, providing a detailed roadmap for success. Learn about essential exam content, explore a wealth of study materials, and discover effective strategies to tackle every challenge with confidence.

Exam Content Overview

Yo, future insurance pros! This is the lowdown on what you gotta know for your P&C exam. Get ready to crush it—this ain’t no joke. It’s all about understanding the ins and outs of property and casualty insurance, from the basic policies to the complex legal stuff.This breakdown will cover the major topics, giving you a solid foundation.

We’ll dissect different types of insurance, policy provisions, and the crucial legal principles. This way, you’ll be totally prepared to ace that exam and become a total pro in the insurance game.

Key Topics in Property and Casualty Insurance

This section gives you a general overview of the essential topics you need to master. Understanding these foundational concepts is super important for your exam success.

- Policy Types: This includes auto, homeowners, commercial, and more. Each policy type has its own specific requirements and coverage details, which are key to understanding the exam questions. For example, an auto policy will differ significantly from a homeowners policy in terms of the perils covered.

- Policy Provisions: Understanding policy language is critical. This means knowing what’s covered, what’s excluded, and how to interpret the fine print. It’s like reading the rules of a game, and knowing the exceptions to the rules is equally important. A good understanding of policy provisions helps avoid misunderstandings and disputes later on.

- Legal Principles: Insurance law is based on a bunch of legal principles. Knowing these will help you analyze cases and situations, and apply the appropriate legal principles in the exam. Things like negligence, estoppel, and waiver are super important.

Auto Insurance Exam Requirements

Auto insurance is a major part of the P&C exam, and you gotta know the specific requirements. This section will help you ace that part of the test.

- Coverage Types: Liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Knowing the different types and what they cover is crucial. For example, liability coverage protects you if you cause damage to another person’s vehicle or property.

- Policy Exclusions: Understanding the exclusions is just as important as knowing what’s covered. This prevents misunderstandings. Examples include intentional acts, certain types of vehicles, or activities.

- State Regulations: Different states have different regulations for auto insurance. Knowing the specifics for the state you’re focused on is super important.

Homeowners Insurance Exam Requirements

Homeowners insurance is another biggie. You need to know the details to pass the exam.

- Coverage Types: Dwelling, other structures, personal property, liability, and additional living expenses. Understanding each type of coverage is important for understanding the exam questions.

- Coverage Limits: Knowing the different coverage limits is critical. For example, the amount covered for damage to the dwelling itself is important.

- Perils Covered: Knowing the perils covered by the policy is a must. Things like fire, windstorm, vandalism, and theft. Each policy will have specific exclusions that you need to know.

Commercial Insurance Exam Requirements

Commercial insurance is a more complicated beast, but totally doable.

- Policy Types: Commercial property, general liability, professional liability, workers’ compensation, and others. Knowing the various policy types and their specific coverage is key.

- Business Needs: Commercial policies are tailored to the specific needs of the business. You need to understand the different types of businesses and the unique risks each faces. A restaurant will have different needs than a construction company.

- Policy Provisions: Commercial policies have many specific provisions related to business operations. Understanding these provisions is vital for the exam.

Study Resources and Materials: P&c Insurance Exam Prep

Yo, future insurance pros! Getting ready for that P&C exam is like prepping for a major battle, and you need the right weapons. This section breaks down the ultimate study resources to totally crush that exam.This is the lowdown on the different study tools out there, from textbooks to online courses. We’ll also give you the inside scoop on what works best for different learning styles, so you can totally personalize your study plan and dominate that test.

Study Guides and Textbooks, P&c insurance exam prep

Different study guides cater to various learning styles and preferences. Some are super detailed, going deep into every little detail, while others are more concise, focusing on the key concepts. This is crucial for figuring out what will best help you retain the info.

- Comprehensive Study Guides: These guides cover the entire curriculum in detail, often with practice questions and explanations. They’re like having a personal tutor on your side, but you gotta be prepared to put in the time to work through all the material.

- Concise Study Guides: These are perfect for reviewing key concepts and formulas. They’re great for quickly refreshing your memory, but they might not have the depth of a comprehensive guide.

- Textbooks: Many textbooks provide a solid foundation for understanding the theoretical side of insurance. They’re essential for grasping the concepts before diving into the more complex stuff. Some are super dense, while others are more approachable, so choose wisely based on your learning style.

Online Resources

Online resources have become super popular for exam prep. They offer flexibility and a wide variety of formats, like videos, practice quizzes, and forums. This can be a game changer for visual learners or those who like a more interactive learning environment.

- Practice Exams and Quizzes: Online platforms often provide practice exams and quizzes to gauge your understanding and identify areas where you need to focus more. These are like mini-simulations of the real thing, so you can get a feel for the format and level of difficulty.

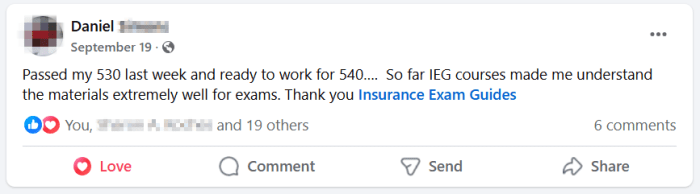

- Online Courses: Many reputable providers offer comprehensive online courses covering all aspects of P&C insurance. These can be super helpful for structured learning and often include interactive elements.

- Exam Prep Websites: Websites specializing in insurance exam preparation offer a variety of resources, including study guides, practice questions, and forums for discussion. They can be a great all-in-one tool for your prep.

Reputable Exam Preparation Courses

Choosing a reputable course provider is crucial for your success. Look for courses from recognized organizations or institutions known for their quality.

- Insurance Institutes: Institutes like the American Institute of Property and Casualty Insurance (AIPCI) often offer exam prep courses. They often have a solid reputation and are a great option.

- Online Education Platforms: Platforms like Udemy, Coursera, or LinkedIn Learning may have insurance-specific courses. However, make sure to thoroughly research the instructor’s credentials and the course content before signing up.

- Independent Providers: Independent providers specializing in insurance exam prep might offer specialized courses or packages. Research thoroughly to ensure their credentials and experience.

Learning Approaches

Figuring out the best learning approach is totally key. Different people learn in different ways, so find what works best for you.

- Active Recall: Actively testing yourself, like through practice questions and quizzes, is a really effective way to retain information.

- Spaced Repetition: Reviewing material at increasing intervals over time helps you retain information better. It’s like training your brain to remember things over a longer period.

- Visual Learning: Using diagrams, charts, and other visual aids can be super helpful for some people. Make sure to use flashcards or diagrams to make the material more engaging.

Study Plan

Your study plan should align with the exam content overview and consider your strengths and weaknesses. Break down the material into manageable chunks and set realistic goals. This is a marathon, not a sprint, so take your time and pace yourself.

Creating a structured study schedule is key. Break down the exam content into smaller, manageable topics. Allocate specific time slots for each topic, ensuring adequate time for review and practice.

Exam Preparation Strategies

Yo, future insurance pros! Aceing this exam ain’t gonna happen by magic. It’s all about a solid game plan, and we’re breaking down the best strategies to crush it. Get ready to level up your study skills!This section dives deep into effective time management, memory hacks, and stress-busting techniques to help you totally dominate your exam prep.

P&C insurance exam prep is undeniably challenging, demanding meticulous study and focused effort. While some might seek distractions like a Seattle underground tour adults only, such as one offered by seattle underground tour adults only , it’s crucial to prioritize the exam. Ultimately, mastering the material is paramount to success in this field.

We’ll cover everything from crafting a killer study schedule to mastering note-taking, so you can feel totally prepared and confident come test day.

Time Management Techniques for Studying

Time management is key to success. Procrastination is the enemy, and a structured approach will help you stay on track and avoid last-minute panics. Figuring out how to best use your study time is crucial.

- Create a Realistic Study Schedule: Don’t try to cram everything into one day. Break down the material into smaller, manageable chunks. Schedule specific times for studying different topics, like a detailed study timetable, and stick to it as much as possible. This will help you stay on track and prevent burnout.

- Utilize Pomodoro Technique: Work in focused bursts (e.g., 25 minutes) followed by short breaks (5 minutes). This helps maintain concentration and prevents mental fatigue. This method is awesome for boosting focus and efficiency.

- Prioritize Tasks: Identify the most important and challenging topics first. Tackle them when you’re most alert and focused. This will make sure you’re getting the most important stuff done first.

- Minimize Distractions: Find a quiet study space free from interruptions. Turn off social media, put your phone away, and let everyone know you need some serious study time. This will make a huge difference.

Memorization Methods for Key Concepts

Knowing the material is half the battle. Mastering memorization techniques can make a huge difference.

- Spaced Repetition: Review material at increasing intervals. This helps reinforce learning and retention over time. This method is like a supercharged memory booster.

- Active Recall: Test yourself frequently. Try to retrieve information from memory without looking at your notes. This strengthens your understanding and memory.

- Mnemonic Devices: Use acronyms, rhymes, or visual imagery to remember complex concepts. This is a super cool way to make the material stick in your brain.

- Flashcards: Create flashcards for key terms and definitions. Use them for quick reviews and spaced repetition. Flashcards are your best friend for memorization.

Sample Exam Schedule

A structured study schedule is essential to avoid last-minute cramming and ensure you’re well-prepared.

| Day | Topic | Study Time (hours) | Review Time |

|---|---|---|---|

| Monday | Insurance Principles | 3 | 1 hour |

| Tuesday | Claims Processing | 2 | 30 minutes |

| Wednesday | Risk Management | 3 | 1 hour |

| Thursday | Review All | 2 | 1.5 hours |

| Friday | Practice Questions | 1 | 30 minutes |

Strategies for Anxiety and Stress

Exam anxiety is totally normal. Developing coping mechanisms is crucial for managing stress.

- Deep Breathing Exercises: Practice deep breathing techniques to calm your nerves before and during the exam. This is a super simple but effective way to manage anxiety.

- Positive Self-Talk: Encourage yourself and remind yourself of your strengths and past successes. Focus on your strengths and accomplishments.

- Exercise: Physical activity can help reduce stress and improve focus. Get some exercise to clear your head and calm your nerves.

- Get Enough Sleep: Adequate sleep is essential for cognitive function and reducing anxiety. Make sure you get enough sleep the night before the exam.

Note-Taking and Review Methods

Effective note-taking and review methods are essential for exam success.

- Active Note-Taking: Summarize key concepts in your own words and add diagrams or examples to aid understanding. This makes sure you’re actively engaged with the material.

- Color-Coding: Use different colors to highlight different topics or concepts. This can make the material easier to understand and recall. Visual aids are super useful.

- Review Summaries: Create concise summaries of each topic after studying. This helps reinforce your understanding and identify areas needing more attention. This is a great way to review and identify areas needing more work.

Practice Questions and Mock Exams

Yo, future insurance pros! Nailed the study plan, now it’s time to put your skills to the test. Practice questions are your secret weapon for acing the exam. They help you pinpoint your weak spots and get super familiar with the material. Think of it like running drills before a big game – you’re gonna dominate!Practice questions are crucial for exam prep.

They’re not just about getting the right answer; they’re about understandingwhy* the answer is right or wrong. This helps you build a strong foundation of knowledge, not just memorize facts. You’ll totally own the exam if you do this right.

Sample Practice Questions

These examples cover different areas and difficulty levels. Practice these and see how you do! Remember, practice makes perfect.

- Basic Concepts: Understanding the fundamentals of property and casualty insurance is essential. These questions will help you grasp the basic ideas. It’s all about knowing the key terms, definitions, and principles.

- Policy Types: Different policies cover different risks. These questions test your understanding of the various types of policies, their benefits, and how they work. This is a crucial area to master for success on the exam.

- Claims Handling: Claims handling is a significant part of the job. These questions will help you understand how to evaluate and handle claims efficiently and effectively. Knowing how to handle claims is a key part of the insurance business.

- Risk Management: Identifying and managing risks is essential for the success of any business. These questions will help you understand how to identify and manage risks.

Practice Question Examples

| Topic | Question | Answer | Difficulty |

|---|---|---|---|

| Basic Concepts | What is the difference between an insured and an insurer? | Insured is the person protected by the insurance, insurer is the company providing the coverage. | Easy |

| Policy Types | A homeowner’s policy covers which of the following? | Damage to the home from fire, theft, or vandalism. | Medium |

| Claims Handling | A policyholder files a claim for damage caused by a storm. What are the key steps in handling the claim? | Investigate the damage, assess the claim, determine coverage, and provide a settlement. | Medium-Hard |

| Risk Management | What are the main types of risk that a business owner needs to consider? | Financial, legal, operational, and reputational risks. | Hard |

Exam Preparation Strategies

Identifying and rectifying weaknesses is key to success. Reviewing your mistakes is crucial for learning and growth.

- Identify Weaknesses: After completing a practice set, review the questions you missed. Analyze

-why* you missed them. Did you not understand the concept, or were you just rushed? This will help you zero in on your problem areas. - Focus on Weak Areas: Spend extra time reviewing the topics where you struggled. Use different resources like textbooks, practice quizzes, or online tutorials to strengthen your understanding.

- Analyze Mistakes: Don’t just look at the correct answer; analyze

-why* the incorrect options are wrong. This deeper understanding will help you avoid similar mistakes on the real exam.

Practice Exam Resources

There are tons of websites that offer practice exams. Some great places to find them are online study guides or exam prep providers.

- Website 1: [Link to website 1]

- Website 2: [Link to website 2]

- Website 3: [Link to website 3]

Understanding Exam Format and Scoring

Yo, future insurance pros! This section’s all about nailing the P&C exam format and scoring system. Knowing the lay of the land is key to acing this test, so let’s break it down.The P&C insurance exam is designed to test your knowledge and understanding of the subject matter. It’s not just about memorizing facts; it’s about applying your knowledge to real-world scenarios.

Getting a handle on the format and scoring will help you strategize your study time and feel more confident when tackling the questions.

Exam Structure

This exam ain’t all multiple choice. Expect a mix of question types to keep things interesting. Multiple-choice questions are a major part, testing your understanding of core concepts. Short-answer questions are also common, forcing you to apply your knowledge and articulate your reasoning. Some exams might even have case studies or scenarios, requiring you to analyze and solve problems like a real-world insurance professional.

Scoring System

The scoring system is pretty straightforward. Each question type usually has a different point value. Multiple-choice questions typically have a set number of points for each correct answer. Short-answer questions will usually be graded based on the accuracy and completeness of your response, and they’re often worth more points than multiple-choice questions. You’ll get a total score, reflecting your overall performance.

Different exam providers might have slightly different scoring methods, so double-checking the specifics is a smart move.

Grading Rubric

Understanding the grading rubric is essential for optimizing your study efforts. Knowing the criteria used to evaluate your answers will help you focus your prep on the most important concepts. A rubric usually Artikels the key elements and details that the examiners look for when grading short-answer questions. If you’re struggling to understand the grading rubric, seeking clarification from the exam provider is a great way to go.

Look for details on the scoring breakdown for each question type.

Types of Exam Questions

The types of questions you’ll encounter vary. Expect questions on fundamental insurance principles, policy provisions, and calculations. You’ll also encounter questions related to different types of insurance coverage, like property, casualty, and liability. Sometimes, you’ll even get questions on the legal aspects of insurance, like contract law and claims procedures.

Sample Exam Question

| Question | Answer |

|---|---|

| A homeowner’s policy covers damage to the home caused by fire. If a fire damages the home, what coverage is triggered? | The dwelling coverage portion of the homeowner’s policy. |

Key Concepts and Formulas

Yo, future insurance pros! This section is all about the core ideas and calculations that’ll totally crush that P&C exam. We’re breaking down the essential concepts and showing you how these formulas actually work in the real world. Get ready to level up your insurance game!This is the juice of the P&C world. Understanding these core concepts and formulas is key to nailing the exam and becoming a total insurance whiz.

We’re not just showing you the formulas; we’re dropping the knowledge bombs on

- why* they work and how they apply to real-life scenarios. This ain’t just memorization; it’s about understanding the

- why* behind the

- what*.

Core Concepts of Property and Casualty Insurance

Property and Casualty (P&C) insurance is all about protecting people and businesses from financial losses. This involves risk assessment, calculating probabilities of loss, and pricing policies accordingly. It’s a complex dance between understanding potential harms and offering affordable protection. It’s like a huge game of predicting the future, but with a whole lot of math and legal stuff.

Key Formulas and Calculations

Knowing the formulas is crucial. These aren’t just random numbers; they’re the building blocks of P&C insurance pricing and claims. Mastering them will unlock a whole new level of insurance understanding.

Expected Loss (EL) = Probability of Loss x Severity of Loss

This formula is the foundation. It calculates the anticipated cost of a loss. Imagine a fire at a warehouse. The formula factors in how likely a fire is (probability) and how much damage it might cause (severity).

Premium = Expected Loss + Loading

Premium is the amount you pay for insurance. It’s more than just the expected loss; it includes the insurer’s profit margin (loading). It’s like the cost of the insurance company running the business.

Pure Premium = Expected Loss

This is the cost of the loss itself, excluding the cost of running the insurance company.

Comparing Formulas and Applications

This table breaks down different formulas and their practical applications.

| Formula | Description | Real-World Example |

|---|---|---|

| Expected Loss (EL) = Probability of Loss x Severity of Loss | Calculates the anticipated cost of a loss. | A homeowner’s insurance policy might use this to predict the expected loss from a fire. |

| Premium = Expected Loss + Loading | Determines the total cost of the insurance policy. | The premium for a car insurance policy includes the expected loss from accidents, plus the insurance company’s profit. |

| Pure Premium = Expected Loss | Represents the cost of the loss alone. | A company using insurance to protect itself from theft. The pure premium is just the expected loss from the theft. |

Importance of Understanding Underlying Reasoning

It’s not just about plugging numbers into formulas; you gotta understandwhy* they work. Understanding the logic behind the calculations is key to applying them correctly and critically evaluating insurance scenarios. You gotta think like an insurance pro, not just a calculator.

Insurance Industry Trends

Yo, future insurance pros! The P&C insurance game is constantly evolving, and understanding these trends is key to crushing that exam. From digital transformation to changing consumer expectations, it’s a wild ride. Knowing the ins and outs of these shifts will make you a total boss in the industry.The insurance industry is experiencing rapid changes driven by technological advancements, evolving consumer behavior, and shifting regulatory landscapes.

Cramming for my P&C insurance exam is brutal, requiring relentless focus. To maintain sanity, a relaxing escape is essential, and the best nail salon spa near me, like this one , provides precisely that. A rejuvenating manicure and pedicure will undoubtedly restore my energy and help me power through the final stages of my exam prep.

These shifts aren’t just affecting how policies are sold; they’re altering the very foundation of how insurers operate. Staying on top of these trends is crucial for success, both in the exam and in your future career.

Current Trends in the P&C Insurance Industry

The industry is totally embracing digital tools. Insurers are using AI and machine learning to automate tasks, personalize policies, and even predict risks more accurately. This tech boom is impacting everything from claims processing to customer service. Insurers are also focusing on customer experience, making things easier and faster for policyholders. They’re offering online portals, mobile apps, and 24/7 support to meet the demands of today’s tech-savvy consumers.

Impact on Exam Content

Exam content is reflecting these changes. Expect more questions on digital tools, data analytics, and customer relationship management (CRM) systems. Understanding how AI impacts risk assessment and claims handling is also becoming a major focus. The exam will test your ability to apply these new technologies to real-world insurance scenarios.

Importance of Staying Updated with Industry Developments

Keeping your finger on the pulse of the insurance world is essential. New regulations, technological breakthroughs, and shifting consumer needs are constantly shaping the industry. Being updated means you’ll be better prepared for the exam and equipped to handle the challenges of a rapidly changing job market.

Potential Future Trends

The future looks pretty wild. Expect even more integration of AI and machine learning into underwriting, claims processing, and fraud detection. Personalized risk assessment, using data to tailor policies to individual needs, is a major trend. The rise of autonomous vehicles will also significantly affect the industry, changing liability models and creating new types of insurance products.

Increased use of telematics and wearable tech to assess risk is also likely to grow.

Recent Regulatory Changes and Their Effect

Recent regulatory changes have been aimed at improving consumer protection and promoting fair competition. New rules are affecting how insurers handle personal data and communicate with customers. These changes impact pricing, underwriting, and claims handling. Understanding these regulations is crucial for exam success and future compliance in the industry. For instance, the increasing focus on data privacy regulations, like GDPR, will affect how insurers collect and use customer information.

Preparing for Different Exam Boards (if applicable)

Yo, future insurance pros! Figuring out which exam board to rock is crucial. Different boards have slightly different vibes, so you gotta know what you’re gettin’ into. Knowing the ins and outs of each board can totally save you time and headaches later.

Identifying Different P&C Insurance Exam Boards

Different organizations offer P&C insurance exams. Some popular ones include the Society of Actuaries (SOA), the Casualty Actuarial Society (CAS), and various state-level licensing boards. Each board has its own specific requirements and focuses, so you gotta do your research. Choosing the right one is key to nailing your goals.

Variations in Exam Content and Format

Exam content and format can differ significantly between boards. Some boards focus more on actuarial concepts, while others might prioritize property and casualty-specific topics. Some might have multiple parts, while others might be one big exam. This variation affects your study plan, so you need to tailor your prep to the specific board’s requirements.

Unique Preparation Strategies for Each Board

Each board’s exam has its own unique quirks. The SOA, for example, often leans into advanced mathematical concepts. The CAS often emphasizes the nuts and bolts of casualty insurance. State licensing exams are usually tailored to the specific state’s requirements. Tailoring your prep to the specific exam’s structure is essential.

Knowing what’s on the exam and how it’s graded is crucial for success.

Comparing Exam Board Curricula

| Exam Board | Focus | Key Topics | Preparation Strategies |

|---|---|---|---|

| SOA | Actuarial science | Probability, statistics, financial modeling | Deep dive into formulas, practice problems, rigorous study of actuarial principles. |

| CAS | Casualty insurance | Risk assessment, claims handling, insurance law | Emphasis on practical application, case studies, understanding specific regulations. |

| State Licensing Boards | State-specific regulations | Insurance laws, licensing requirements, and state-specific regulations | Focus on state-specific laws, regulations, and rules. Thorough review of the state’s licensing requirements. |

This table gives a general overview. Specific topics and weights can vary. Always double-check the official board websites for the most up-to-date and accurate information. This is super important for planning your study schedule.

Conclusive Thoughts

In conclusion, conquering the p&c insurance exam demands a strategic approach, combining a deep understanding of the subject matter with effective study techniques. This guide has equipped you with the knowledge and tools necessary to achieve your goals. Embrace the challenge, refine your skills, and emerge victorious. Remember, preparation is key; now go forth and excel!

Q&A

What are the most common types of insurance products covered in the exam?

Auto, homeowners, and commercial insurance products are frequently assessed. Understanding the specifics of each type, including policy provisions and associated risks, is crucial for exam success.

How can I effectively manage my study time for the exam?

A well-structured study plan is essential. Break down the material into manageable sections, allocate specific time slots for each topic, and incorporate regular review sessions to reinforce learning.

What resources are available to aid in my exam preparation?

Various study materials, including reputable study guides, textbooks, and online resources, can enhance your learning experience. Comparing different resources and identifying their strengths and weaknesses can help you tailor your approach.

How can I effectively analyze my mistakes on practice questions?

Thoroughly analyze each incorrect answer. Understand the underlying concepts or formulas involved, and focus on reinforcing those areas. Practice questions are invaluable for identifying knowledge gaps.