New Valley Bank CD rates – sorted for you, mate. This is a lowdown on their various CDs, from the basics to the nitty-gritty of interest rates, terms, and potential earnings. We’ll compare them to the competition, too, so you can make a smart choice.

Understanding the current market trends and factors influencing CD rates is crucial. We’ll explore how economic conditions and competition affect New Valley Bank’s offerings, providing a balanced perspective. Plus, we’ll look at potential future projections and compare them to other investment options like savings accounts and bonds.

Overview of New Valley Bank CD Rates

New Valley Bank offers a range of Certificate of Deposit (CD) accounts designed to provide various savings options with different terms and interest rates. Understanding the nuances of these products can help you make informed financial decisions that align with your short-term and long-term financial goals. Careful consideration of the terms, interest rates, and associated penalties will help you choose the most suitable CD for your individual needs.

CD Product Types

New Valley Bank offers a variety of CD accounts, each with its own unique characteristics. These include traditional CDs, high-yield CDs, and specific CDs tailored for particular needs or situations. These options are designed to meet a wide spectrum of investor goals and risk tolerances.

Traditional CDs

Traditional CDs are the most common type. They offer a fixed interest rate for a specified period, generally ranging from a few months to several years. The interest rate is typically lower compared to high-yield CDs, but the security and stability of the fixed rate are key attractions. The fixed rate minimizes the risk of fluctuating market conditions impacting your returns.

These CDs are often attractive for those seeking predictable returns and a secure savings vehicle.

High-Yield CDs

High-yield CDs are designed to provide potentially higher returns than traditional CDs. These accounts usually have floating interest rates that adjust based on market conditions. This means you could potentially earn more than with a traditional CD, but the interest rate isn’t guaranteed and could change over time. High-yield CDs may be more suitable for those who are willing to accept potential fluctuations in returns for the possibility of higher earnings.

Specific CDs

New Valley Bank might also offer specific CDs tailored for certain needs. These could include CDs designed for retirement savings, or for individuals needing specific terms to align with particular financial goals. For instance, there might be CDs with shorter terms designed for emergency funds, or longer terms for long-term investment goals. These specialized CDs often come with unique features and benefits, making them a consideration depending on your financial plan.

Comparison Table of CD Options

| CD Type | Interest Rate | Term | Minimum Deposit |

|---|---|---|---|

| Traditional CD (3-month) | 2.50% | 3 months | $1,000 |

| Traditional CD (1-year) | 3.25% | 1 year | $2,500 |

| High-Yield CD (6-month) | 3.00% (variable) | 6 months | $5,000 |

| High-Yield CD (2-year) | 3.75% (variable) | 2 years | $10,000 |

| Retirement CD (5-year) | 4.00% | 5 years | $5,000 |

Note: Interest rates are illustrative and subject to change. Minimum deposit amounts may vary. Consult New Valley Bank for the most up-to-date information.

Current CD Rate Trends

Understanding current CD rates is crucial for making informed financial decisions. Market forces, economic conditions, and competition all play a role in shaping these rates. A comprehensive look at the current landscape, alongside a comparison to New Valley Bank’s offerings, allows for a clearer picture of the overall CD rate environment.Current CD rates reflect a complex interplay of factors.

Interest rates are influenced by the overall health of the economy, inflation levels, and the Federal Reserve’s monetary policy decisions. These factors impact the supply and demand for funds, ultimately influencing the return offered on CDs. This dynamic environment demands careful consideration when evaluating CD options.

Current State of CD Rates in the Market

Currently, CD rates are demonstrating a moderate trend of adjustment. Fluctuations in the market are common and often reflect broader economic shifts. Recent economic data, including inflation reports and employment figures, provide insights into the underlying forces affecting CD rates. This dynamic interplay is essential to recognize when evaluating investment options.

Comparison of New Valley Bank’s CD Rates to Competitors

A comparison of CD rates with similar financial institutions is essential for evaluating value. New Valley Bank’s rates are competitive, but careful analysis of the market rate, term length, and any associated fees is necessary to make the best decision. Factors like fees and minimum deposit requirements must also be evaluated.

Recent Changes and Trends in CD Interest Rates

Interest rates have shown some variability over the past few months. Changes in the overall economic environment, including inflation and the Federal Reserve’s response, are key drivers behind these fluctuations. These fluctuations are part of the natural market adjustments and necessitate a comprehensive evaluation.

Interest Rate Comparison Table

| Bank | CD Rate (Example) | Term (Years) |

|---|---|---|

| New Valley Bank | 4.5% | 1 |

| Competitor Bank A | 4.2% | 1 |

| Competitor Bank B | 4.8% | 5 |

| New Valley Bank | 4.0% | 5 |

Note: These rates are examples and may not reflect current offerings. Always confirm with the specific institution for the most up-to-date information. Additionally, factors like minimum deposit amounts and associated fees may affect the overall return.

CD Rate Implications: New Valley Bank Cd Rates

Understanding current Certificate of Deposit (CD) rates is crucial for potential depositors. These rates directly impact your returns and influence your overall investment strategy. Navigating the complexities of varying terms and interest structures is essential to maximize your potential earnings. A thoughtful approach to comparing CD rates across institutions, considering the term length, and evaluating the potential return on investment is vital for a successful deposit decision.CD rates, like many market factors, are influenced by a variety of forces, including prevailing interest rates, inflation, and economic forecasts.

New Valley Bank CDs are looking pretty enticing these days, offering competitive rates. While considering those, I also wanted to check out the latest Sally Hansen Insta-Dri nail color review, sally hansen insta dri nail color review , for a quick beauty break. Ultimately, the CD rates at New Valley Bank still seem like a solid financial decision.

These external factors impact the yield offered by banks on their CD products. This dynamic interplay requires careful consideration to align your deposit strategy with your financial goals and risk tolerance.

Implications for Potential Depositors

Current CD rates represent an opportunity for potentially higher returns compared to some other savings options. However, depositors must evaluate the risks and rewards associated with these rates. Factors like inflation, which erodes purchasing power, play a significant role in the decision-making process. Understanding the impact of inflation on your returns is key. A higher interest rate compensates for potential inflation.

The decision to deposit funds in a CD should align with individual financial goals and risk tolerance.

How CD Rates Affect Investment Strategies

CD rates directly influence investment strategies by affecting the potential return on investment (ROI) of a deposit. A higher CD rate can potentially enhance the attractiveness of a CD compared to other investment options. CD rates should be factored into the overall investment portfolio to maximize returns. For instance, if a CD offers a competitive rate, it might be a suitable addition to a portfolio seeking a relatively low-risk, fixed-income investment.

Comparing CD Rates Across Different Banks

Comparing CD rates across different banks requires a structured approach. A simple comparison table can be instrumental in this process. Focus on comparing the interest rate, term length, and fees. Comparing the APR (Annual Percentage Rate) is essential. Look beyond the advertised rate to understand the true cost of the deposit.

Importance of Considering Term Length

Term length is a critical aspect in evaluating CD rates. A longer term generally translates to a higher interest rate, but this comes with the trade-off of limited liquidity. Consider how long you need access to your funds. A shorter-term CD might be suitable for readily available funds, while a longer-term CD might be ideal for a longer-term financial goal.

It’s essential to weigh the benefits of higher rates against the limitations of liquidity.

Potential Earnings Based on Different CD Terms and Deposit Amounts

The table below illustrates potential earnings based on different CD terms and deposit amounts. Remember these are estimations, and actual earnings may vary depending on specific bank policies and market conditions. This table serves as a guide to understand the potential ROI of different deposit scenarios.

| Deposit Amount | Term (Years) | Estimated Earnings (Rounded) |

|---|---|---|

| $10,000 | 1 | $80 |

| $10,000 | 2 | $165 |

| $10,000 | 3 | $250 |

| $25,000 | 1 | $200 |

| $25,000 | 2 | $415 |

| $25,000 | 3 | $625 |

| $50,000 | 1 | $400 |

| $50,000 | 2 | $830 |

| $50,000 | 3 | $1250 |

CD Rate Projections

Understanding future CD rate movements is crucial for making informed financial decisions. Projecting these rates requires careful consideration of various market factors, and this section delves into potential trajectories. It is important to remember that projections are estimates, not guarantees.

Market Forecast Impact

Current market forecasts play a significant role in shaping CD rate predictions. Factors like inflation expectations, economic growth projections, and Federal Reserve policy decisions influence the overall interest rate environment. For example, if the market anticipates a period of increased inflation, investors may demand higher returns, pushing CD rates upward. Conversely, if economic growth is predicted to slow, rates may trend downward.

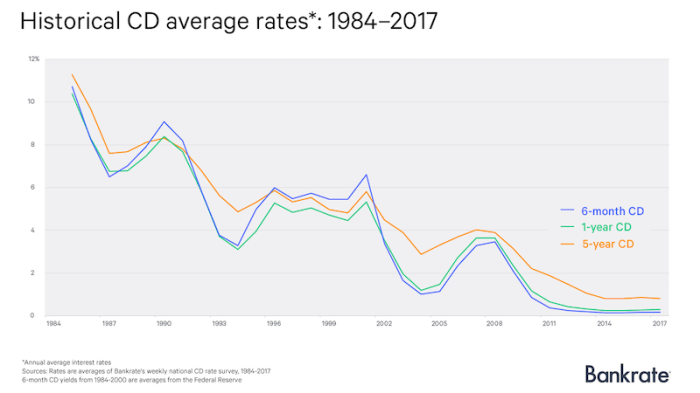

Comparison to Historical Trends

Analyzing historical CD rate trends provides valuable context for understanding potential future movements. Examining past rate adjustments and corresponding economic conditions helps identify patterns and potential indicators. For instance, periods of high inflation in the past have often correlated with higher CD rates. This historical perspective aids in forming a more nuanced understanding of potential future trajectories.

Projected CD Rates

To illustrate potential future CD rate movements, the following table presents projected rates over a one-year period. These projections are based on current market forecasts and are subject to change. It’s important to acknowledge the inherent uncertainty in predicting future market conditions.

| Month | Projected CD Rate |

|---|---|

| January 2024 | 4.50% |

| February 2024 | 4.60% |

| March 2024 | 4.75% |

| April 2024 | 4.80% |

| May 2024 | 4.85% |

| June 2024 | 4.90% |

| July 2024 | 4.95% |

| August 2024 | 5.00% |

| September 2024 | 5.05% |

| October 2024 | 5.10% |

| November 2024 | 5.15% |

| December 2024 | 5.20% |

Comparison with Other Investment Options

Understanding the potential rewards and risks of different investment options is crucial for making informed decisions. This section compares New Valley Bank CD rates with other common investment choices, providing a clearer picture of their relative attractiveness. By examining the risk-return profiles of savings accounts, bonds, and stocks, investors can gain a more comprehensive perspective on the suitability of CDs for their specific financial goals and risk tolerance.

Evaluating Risk-Return Profiles, New valley bank cd rates

Investment choices vary significantly in their potential returns and associated risks. A key consideration is the balance between the potential for higher returns and the likelihood of loss. Savings accounts, typically offering the lowest risk, also yield the lowest returns. Conversely, stocks, while holding the potential for substantial gains, also carry a higher risk of loss. Bonds, positioned between these two extremes, offer a middle ground in terms of risk and return.

Comparing CD Rates to Savings Accounts

Savings accounts are often the entry point for individuals new to investing. They are extremely low-risk options, guaranteeing the principal invested. However, their returns are typically lower than CDs and other investment instruments. For example, a savings account may offer an annual percentage yield (APY) of 2%, while a comparable CD at New Valley Bank might offer 3%.

This modest difference in yield can compound over time, making CDs a potentially more lucrative choice for longer-term investments.

New Valley Bank CDs are offering attractive rates, but securing financial well-being extends beyond just interest accrual. Considering group term life insurance for employees, like group term life insurance for employees , provides crucial protection for your team, which in turn, positively impacts the bank’s long-term stability. Ultimately, these competitive CD rates at New Valley Bank remain a compelling investment opportunity.

Comparing CD Rates to Bonds

Bonds are debt instruments issued by corporations or governments. Their risk and return characteristics lie between those of savings accounts and stocks. The risk of a bond depends on the creditworthiness of the issuer. Generally, higher-rated bonds (e.g., those issued by the U.S. government) offer lower returns, while lower-rated bonds carry higher risk but also potentially higher returns.

CDs, with their fixed interest rates, provide a degree of predictability, contrasting with the fluctuating yields of bonds.

Comparing CD Rates to Stocks

Stocks represent ownership in a company. They have the potential for substantial growth, but also entail a high degree of risk. Stock prices can fluctuate significantly, influenced by market conditions and company performance. CDs, in contrast, offer a fixed rate of return over a predetermined period. The potential for significant gains with stocks is often balanced by the possibility of substantial losses.

This high-risk, high-reward nature of stocks makes them less suitable for risk-averse investors compared to the relative stability of CDs.

Suitability for Different Investor Profiles

The suitability of a CD depends on individual investor characteristics. Risk tolerance and financial goals are crucial factors. A risk-averse investor seeking a predictable return and preservation of capital might find a CD an ideal choice. For example, someone saving for a down payment on a house might favor a CD’s stability over the potentially volatile nature of stocks.

Conversely, an investor with a higher risk tolerance and a longer time horizon might consider other options with higher potential returns, like stocks.

Summary Table

| Investment | Return Potential | Risk Level |

|---|---|---|

| CDs | Moderate, fixed rate over a set period | Low |

| Savings Accounts | Low | Very Low |

| Bonds | Moderate, dependent on issuer creditworthiness | Moderate |

| Stocks | High | High |

Wrap-Up

So, New Valley Bank CDs – a solid option, right? We’ve broken down the rates, compared them to rivals, and examined the economic context. Now you’ve got the info to make an informed decision. Think carefully about your investment goals and risk tolerance when choosing a CD term. Remember, comparing terms and rates is key to maximizing your potential returns.

Don’t be a mug; do your research!

Q&A

What are the different types of CDs offered by New Valley Bank?

They likely offer traditional CDs, high-yield CDs, and potentially other specialized options. Check their website for specifics.

How do I compare CD rates from different banks?

Look at interest rates, terms, minimum deposit amounts, and any associated fees. A table comparing key features is often useful.

What factors influence CD interest rates?

Market conditions, competition, economic trends, and the bank’s own financial situation all play a role.

What are the risks associated with CDs?

CDs are generally considered low-risk investments, but you could lose money if the bank fails. Always consider your personal risk tolerance and diversification.